How Much is a Beer and Wine License in Florida?

You are in the right place if you’re wondering, “How much is a beer and wine license in Florida?”. This article will cover this question and many other vital questions.

How Much is a Beer and Wine License in Florida?

How much is a beer and wine license in Florida? The cost for such a license in Florida varies significantly based on the county. The cost can vary significantly, ranging from as low as $28 to as high as $1,820. Factors such as the Population of the county and license availability can have an impact on the final price.

However, navigating the process and understanding the nuances can be a game-changer.

Hey there,

I’m Jeff, a restaurant consultant living right here in the sunny state of Florida. Over the years, I’ve helped countless restaurant owners like you navigate the complex world of licenses and permits.

Today, I’m drawing from my personal experiences to shed light on Florida’s intricate web of beer and wine licenses.

Let’s dive in.

Understanding the Cost Variations

Now, I know what’s running through your mind: “Why such a big range in licensing costs, Jeff? From $28 to $1,820? That’s quite a spread!” I’ve been through the same roller-coaster of emotions and confusion with my clients. So, let’s demystify these numbers.

Factors Influencing the Cost:

Based on Counties:

Miami-Dade County: Picture this – you’re in Miami, home to South Beach, Art Deco, and a bustling nightlife. The county’s vibe, coupled with its high Population, makes the cost tilt towards the higher end.

Monroe County (Florida Keys): On the other end, in the relaxed Florida Keys, where life’s a bit more laid-back, licenses are a tad more affordable. Still, the paradise vibe has its price tag.

Population Dynamics:

High Population = Higher Demand: The simple law of supply and demand comes into play here. In areas like Tampa or Orlando, where populations are booming, there’s a rush for these licenses, pushing the prices up.

Lower Population Areas: In contrast, in some quieter counties where the crowd is sparse, the demand is naturally less, making licenses a bit lighter on the pocket.

License Availability:

Quota Licenses: In some parts of Florida, licenses are issued based on a quota system. This means only a limited number of licenses are available, and they’re often grabbed as soon as they’re released. I’ve seen people wait and even bid for them!

Non-quota Licenses: Meanwhile, it’s a smoother sail in other areas. Non-quota licenses, especially those meant just for beer and wine, often have more leniency in availability and price.

To put it in perspective, envision opening a restaurant near Disney World versus a quiet spot near the Everglades.

Different vibes, different crowds, and, yes, different license costs. Always remember to factor in these dynamics when budgeting for your dream restaurant.

And if ever in doubt, drop me a line or message me; I’ve got your back.

The Big Question: How Much is a Beer and Wine License in Florida?

I’m sure you’ve heard variations of the costs, but here’s a concise breakdown:

Beer and Wine Licenses: Depending on the county’s Population and your establishment’s nature, you’re looking at costs ranging from:

- 1APS (Beer Package Sales) – $20 to $100 + additional fees.

- 2APS (Beer & Wine Package Sales) – $60 to $140 + fees.

- 1COP & 2COP for on-premise consumption vary between $40 and $280.

Beer, Wine, and Liquor Licenses: Again, prices adjust based on county population:

- Package Sales (3PS, 3APS, etc.) range from $468 to $1,365.

- On-premise consumption (4COP, 5COP, etc.) can be anywhere from $624 to $1,820.

Special Licenses for Clubs & Organizations: If you’re venturing into this niche, fees can be as low as $400 or go up to $1,820, depending on the type of establishment.

Remember, these numbers are ballpark figures. You’d need to look at the county’s specifics and the kind of establishment you’re running for exact costs.

Beer, Wine, and Liquor License Costs in Florida: A Deep Insight

For numerous entrepreneurs, owning a Florida establishment that serves alcoholic beverages presents an alluring opportunity.

Like other states, Florida follows a well-defined licensing system, which entails differing costs depending on the business nature and the types of beverages to be offered.

This article offers valuable insights into the intricate intricacies and diverse pricing of liquor licensing in the Sunshine State.

Costs Based on Type of Liquor License

Liquor licensing in Florida is differentiated by the kind of alcoholic beverages you plan to sell or distribute. It’s also affected by the availability of these licenses and the county where your business is located. Here’s a breakdown of the costs:

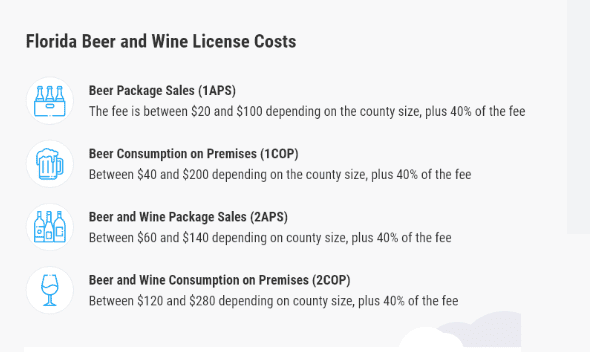

Beer and Wine Licenses: The cost of these licenses varies based on the county’s Population. For instance:

- 1APS (Beer Packages Sales) costs between $20 and $100, with an additional 40% of the fee.

- 1COP (Beer Consumption on Premise) ranges from $40 to $200, plus 40% of the fee.

- 2APS (Beer and Wine Package Sales) is priced between $60 and $140, with an extra 40% of the fee.

- 2COP (Beer and Wine Consumption on Premise) ranges from $120 to $280, plus 40% of the fee.

Beer, Wine, and Liquor Licenses: The costs of these licenses also depend on the county’s Population. On average:

- 3PS licenses (Package Sales) cost $1,365.

- 3APS licenses are priced at $1,170.

- 3BPS licenses come at $975.

- 3CPS licenses are $643.50.

- 3DPS licenses are available for $468.

For Consumption on Premise:

- 4COP licenses are at $1,820.

- 5COP licenses come in at $1,560.

- 6COP licenses are priced at $1,300.

- 7COP licenses are available for $858.

- 8COP licenses cost $624.

Understanding the Types of Liquor Licenses Available in Florida

There are multiple licenses, each catering to specific business needs. Here’s a quick rundown:

- SRS Restaurant License: Ideal for restaurants with over half of their sales coming from food.

- Quota License: This all-in-one license lets you sell beer, wine, and liquor. It’s the golden ticket, but it can be challenging to obtain.

- Beer and Wine License: For those wanting to stick to the basics – beer and wine. It’s a popular choice for many establishments.

- Miscellaneous Licenses: These cater to unique business requirements and usually cost around $100.

The Road to Getting that License

You’ve set your sights on that license, but how do you get it? Start with the ABT – they’re the gatekeepers.

Obtaining an Employer Identification Number (EIN) and officially registering your business with state and federal authorities is vital for legal compliance.

Complete the application, undergo an on-site inspection, and you’ll have that license if everything goes well. But always be cautious of where you’re setting up shop. Only some counties in Florida are as liquor-friendly as the next.

Still with me?

I know, it’s a lot. But hey, if you’ve made it this far, you’re serious about making your mark in Florida’s vibrant alcohol scene.

And with the info-packed above, you’re well on your way.

The Florida DBPR’s Role

Let’s discuss an essential player in our beer and wine licensing game – the Florida Department of Business and Professional Regulation (DBPR). Trust me, you’ll hear much about them as you tread this path.

Introduction to DBPR and Its Significance:

First off, what is the DBPR? Think of the DBPR as the guardian of professionalism in Florida’s vibrant business ecosystem.

Their mission? To ensure every business – from nail salons to skyscraper constructions and our beloved restaurants – operates within the bounds of quality, safety, and the law.

Regarding the food and beverage scene, they ensure your favorite Friday night haunt is fun and safe.

Requirements Set by the DBPR for Obtaining the License:

- Alcoholic Beverage License Application: Before you even think of pouring out that first glass of Chardonnay, you’ll need to send your alcoholic beverage license application to the DBPR. Pro-tip from yours genuinely: Be meticulous with your paperwork. One oversight can set you back weeks!

- Approval from the Florida Department of Revenue: It gets tricky here. Before DBPR gives you the green light, they want a nod from the Florida Department of Revenue. Why, you ask? They need to ensure you’re registered for sales and use tax. It’s their way of ensuring that the state’s coffers benefit from your entrepreneurial venture. If you’re wondering about registration, visit the Department’s Account Registration webpage. It’s a goldmine of information.

- Sales and Use Tax Certificate: Keep that sales and use tax certificate handy once registered. You’ll need it for your application; believe me, having it at your fingertips will make your life much easier.

- Email Your Application: Once all the I’s are dotted and the T’s crossed, send that application to GTA_BeverageLicenseApproval@floridarevenue.com. Remember to include your business partner number if you have one – it can speed up the review process.

Embarking on the DBPR journey can feel like navigating uncharted waters. But fear not! You can conquer the storm with a dash of patience and an unwavering attention to detail.

And remember, the rewards that await – a vibrant, bustling restaurant filled with joyful patrons – make every trial along the way oh so worthwhile.

Aligning with the Florida Department of Revenue

Let’s move from the DBPR and align with the Florida Department of Revenue. You might think, “Jeff, why are we talking about the Department of Revenue in our beer and wine licensing journey?”

Good question! Grab a comfy seat (maybe even a cold brew), and dive in.

Importance of the Department of Revenue’s Approval

The Florida Department of Revenue isn’t just about collecting taxes – although that’s a massive part of its role.

For us in the restaurant business, their approval is a seal of authenticity. It’s saying, “Hey, this business is legit, and they’re contributing their fair share to the state.” You need their approval before you start thinking about that first cheers with your patrons.

No shortcuts here.

Navigating Sales and Use Tax Registration

- How to Register: If terms like “sales and use tax” make you break out in cold sweats, don’t panic! The registration process is pretty straightforward. You’ll need to complete a form (yes, I know, more paperwork) to declare your intent to collect sales tax. It’s your ticket to being recognized as a bona fide restaurant or bar owner in the state. Also, this isn’t a “one-size-fits-all” kind of deal. Depending on your business model – be it a wine bar, a full-fledged restaurant, or a quaint little brewery – the specifics might vary. Make sure you’re picking the correct category.

- Importance of the Account Registration Webpage: This is where the magic happens, my friends. The Account Registration webpage is a portal that holds the keys to your registration process. Everything you need to know, from documentation requirements to guidelines, is right there. It’s a lifesaver for someone like me who likes to have all his ducks in a row.

Aligning with the Florida Department of Revenue is like ensuring your restaurant’s foundation is rock solid.

A little time spent here ensures smooth sailing as your business takes off.

Beer and Wine License in Florida: The Application Process Simplified

Over the years, I’ve seen many a restaurant owner’s eyes glaze over when it comes to the nitty-gritty of licensing.

But guess what? It doesn’t have to be a dreaded task.

Let’s break down the application process into simple steps that even my grandma could follow (and trust me, she still uses a flip phone).

Step-by-Step Guide to Applying:

- Do Your Homework: Before you even think of emailing, make sure you’ve got all your documents ready. This includes your business plan, sales and use tax certificate, and other required documents specific to your locale or business model. You would only go into the kitchen with your ingredients prepped, right? Treat this the same way.

- Emailing the Right Department: Here’s where it gets a tad specific. You’ll be reaching out to the folks at GTA_Beverage_License_Approval@floridarevenue.com. Yeah, it’s a mouthful, but these gatekeepers will give your application the green light.

- Necessary Details to Include in the Application:

- Business Partner Number: If registered with the Department of Revenue (and you should be by this step), you’ll have a business partner number. It’s like your unique ID in their system.

- Sales and Use Tax Certificate Number: This proves you’re on board with responsibly handling taxes. It’s a non-negotiable.

- Personal & Business Details: The basics, like your name, business name, address, contact details, and a brief about your business. Remember, paint a clear picture but keep it concise.

- A Signed Copy of Your Application: This might sound obvious, but you’d be surprised how many folks miss this! Ensure you have a completed application form, signed and ready to go.

Voilà! That wasn’t so bad.

With this roadmap, you’ll navigate the application process like a pro. And hey, if you ever find yourself scratching your head or need some moral support, shoot me a message.

After all, nothing bonds people like shared paperwork woes.

Navigating the Complexities of License Types

By now, you’re seeing the multifaceted world of alcohol licensing in Florida. But bear with me as we delve a little deeper into the maze.

In the restaurant business in this sunny state, understanding the distinctions between the licenses is crucial, especially when you’re looking to serve more than just beer and wine.

So, grab your notepad, and let’s clarify a few more points.

Differences in Licenses Based on Alcohol Types:

In Florida, not all alcohol is treated the same, at least license-wise. Here’s the scoop:

- A non-quota license will do the trick if you only want to serve beer and wine.

- Are you dreaming of a full bar with a range of cocktails? You’d need a different, more comprehensive license that allows selling spirits.

The Need for Different Licenses for Selling Liquor in Addition to Beer and Wine:

If your restaurant’s vibe is more like craft beers and refined wines, great! But suppose you’ve got plans to add Margaritas and Mojitos to the mix. In that case, you must secure a separate liquor license.

- Why, you ask? Well, each type of alcoholic beverage has its own set of regulations and responsibilities. Ensuring the proper licenses means you are on the right side of the law and can offer a diverse drink menu to your patrons without any legal hiccups.

- Consultation is Key: Given the intricacies involved, consulting with a licensing specialist or attorney is often wise. They can guide you on which license suits your business model best and help you navigate the application process smoothly.

Navigating through the complexities of alcohol licenses in Florida can indeed feel like steering through a storm at times.

But remember, understanding the nuances can make your voyage smoother and keep your establishment in full compliance with the law.

I’m here to lend a helping hand and share my experiences to make your journey less daunting.

So, whether it’s a quiet wine bar or a lively pub you’re dreaming of, let’s ensure you’re well-equipped to bring your vision to life, legally and successfully.

Why Consulting an Expert Matters

Now, I’m all about DIY and learning from experiences. However, sometimes calling in the experts is best when navigating the intricate licensing world. Let me explain why seeking advice from professionals in this field can be a game-changer.

The Advantage of Seeking Advice from Attorneys or Licensing Specialists:

- Knowledge is Power: These experts have their fingers on the pulse of the latest regulations, changes, and nuances in the licensing world. Their insights can be invaluable, ensuring you’re always up-to-date and compliant.

- Save Time & Money: Trust me, I’ve been there! Thinking you’ve got it all figured out, only to realize there was a form you missed or a clause you should have noticed. Professionals help you avoid these costly mistakes, making the process streamlined and efficient.

- Tailored Guidance: Every restaurant has its own vibe and business model. Experts can provide advice tailored to your needs, ensuring you get the license that best aligns with your vision.

Navigating the Pitfalls and Complexities of Licensing:

- Avoid Common Mistakes: It’s easy to misinterpret a clause or forget a crucial step in the application process. Expert guidance can help sidestep common pitfalls, smoothing your licensing journey.

- Peace of Mind: Knowing you’ve got an expert in your corner can be reassuring. It lets you focus on what you do best – running your restaurant and delighting your customers. At the same time, they handle the nitty-gritty of licensing.

Application Tips for Faster Approval

I remember the excitement of setting up my first restaurant and the anxiety of waiting for that all-important license. Based on my adventures (and misadventures), here’s my advice on how to get that application zipping through the process.

Ensuring Correct Registration with the Department of Revenue:

- Do Your Homework: Understanding the requirements before diving head-first into the application. Remember, it’s essential to be registered with the Florida Department of Revenue. Think of it as the foundation upon which your application is built.

- Triple Check Everything: I can’t stress this enough. It might sound tedious, but ensuring accurate details can save you from those unwanted hiccups later. After all, even a minor oversight can cause delays.

- Stay Organized: Keep all your registration documents in one accessible place. If the Department needs additional information, you can provide it promptly.

The Importance of Business Partner Numbers and Sales and Use Tax Certificate Numbers:

- Your Key Identifiers: Consider these numbers your unique ID in the licensing world. They’re essential for the Department to identify and process your application.

- Speed up the Review: When emailing your application, include your business partner and sales and use the tax certificate number. This isn’t just a formality. It genuinely helps the reviewers to expedite your application.

- Keep Them Safe, Keep Them Handy: In my early days, I remember scrambling to find these numbers when asked for them. Learn from my rookie mistakes; keep them somewhere you can easily access.

Duration Expectations: How Long Should You Wait?

The waiting game for a beer and wine license in Florida can test your patience. But let me shed some light on the process and set your expectations right based on my journey and the stories of many others I’ve helped along the way.

Variations in Approval Times Based on Counties:

- The ‘County Quirk’: Florida is diverse, and so is the speed at which different counties process these licenses. One county might have you sipping on that celebratory drink in just a few weeks, while another might take a tad longer.

- Population Dynamics: Counties with larger populations or those with a higher density of restaurants might have a more extended review process. It’s not personal; it’s just a numbers game.

Anecdotal Timelines – From Weeks to Months:

- The Speedy Gonzales: A friend in a less populated county got his approval in just four weeks. Yep, you heard right, four weeks! He was as shocked as you probably are right now.

- The Marathoner: On the flip side, another buddy in a bustling county had to wait three months. It was a nail-biter, but he eventually got it, and his restaurant thrived.

- The Middle Road: Most folks I’ve chatted with tend to get their licenses between six to eight weeks. It’s neither fast nor slow – just somewhere comfortably in the middle.

Key Takeaways for Restaurant Owners in Florida

We’ve been through quite a journey, haven’t we? From diving into costs to dissecting the intricacies of Florida’s beer and wine license processes, there’s a lot to take in. Let’s boil down some of the most pivotal points for you as you embark on this exhilarating restaurant journey in the Sunshine State.

- Understand the Cost: Florida’s license costs are as varied as our beautiful beaches. From county to county, prices swing based on population dynamics and license availability. Always factor these variables into your budget.

- The Mighty DBPR: The Florida Department of Business and Professional Regulation isn’t just another government entity. It’s the gatekeeper of your dreams, and understanding their requirements can make your license acquisition journey much smoother.

- Befriend the Department of Revenue: Ensure you’re registered for sales and use tax. It’s not just a bureaucratic step; it’s a crucial part of getting the green light for your application.

- Details, Details, Details: When applying, ensure you’ve got all your ducks in a row. Every detail speeds up the process, from your business partner number to the sales and use tax certificate number.

- License Diversity: From non-quota licenses to other alcohol-related permits, Florida’s a flavor for everyone. Understand what your establishment needs to ensure you’re applying for the right one.

- When in Doubt, Seek Expertise: It might seem tempting to navigate this process solo, but trust me, consulting an expert can save you time, money, and a lot of headaches.

- Patience is Key: Approval times can range from sprints to marathons. But remember, every good thing is worth the wait!

- Adherence for Smooth Operations: Once you’ve got that license, ensure you adhere to all guidelines and regulations. It’s not just about getting started; it’s about sustaining a successful venture.

Frequently ASKED Questions

How Much Is a Wine and Beer License in Florida?

In Florida, the annual fee for a liquor license varies from $14 to $1,828, contingent on the desired license type and the location of the business.

Is It Hard to Get a Beer and Wine License in Florida?

The complexity of obtaining a license depends on the specific type you need. Acquiring a beer or wine license is relatively straightforward, but procuring a quota liquor license, which permits the sale of hard liquor, is more challenging.

Do You Need a License to Sell Beer and Wine in Florida?

Yes, any business in Florida intending to serve or sell alcoholic beverages, including beer and wine, must secure the appropriate permit. This mandate applies to serving drinks, retail beer sales, or even storing alcohol on the premises.

How Long Does It Take to Get a Beer and Wine License in Florida?

After submitting your application, the division will review it and schedule an inspection for your establishment. The decision to grant or reject your application follows this. Typically, the license arrives by mail after approval within one to three months.

Can a Food Truck Sell Beer and Wine in Florida?

In most states, including Florida, food trucks are not permitted to have a full liquor license. They might obtain short-term licenses for events, but routinely selling alcohol should be excluded from a Florida food truck’s regular business plan.

How Do I Get a Beer and Liquor License in Florida?

To obtain a license for selling alcoholic beverages in Florida, you have two options. First, visit the Division of Alcoholic Beverages and Tobacco page on the DBPRs. Alternatively, you can conveniently apply online at Open My Florida Business.

What Can I Serve with a Beer and Wine License in Florida?

Holders of a 2COP license in Florida, such as restaurants, cafés, and sports bars, can serve and sell beer and wine for consumption on the premises. They can also offer package sales in sealed containers unless local municipal regulations prohibit them.

How Much Is a Beer and Wine License in Miami?

For an annual fee of $196, the 2APS license allows the selling of beer and wine for off-premise consumption in sealed packages. The 3PS license, with an annual fee of $1,365, permits the sale of beer, wine, and spirits for off-premise consumption in package stores.

Can You Transfer a Beer and Wine License in Florida?

Yes, transferring a liquor license in Florida is not only allowed, but it’s often the most practical way to obtain one without enduring a lengthy waiting period. It’s noteworthy that securing a license to sell alcoholic beverages in Florida can be challenging.

How Old Do You Have to Be to Sell Beer and Wine in Florida?

You must be 18 years old to sell beer and wine in Florida.

Conclusion

As we conclude our dive into beer and wine licensing in our beautiful state, I want to leave you with some final thoughts.

Owning a restaurant is more than crafting delicious menus and setting up a delightful ambiance. Behind the scenes, it ensures every ‘T’ is crossed and every ‘I’ is dotted. It’s about compliance, responsibility, and a strong foundation that allows your business to thrive in the long run.

The beer and wine license might seem like a small cog in the vast machinery of restaurant management, but its significance can’t be understated. It’s a testament to your commitment to providing exceptional service and operating within the bounds of the law and with the utmost integrity.

So, as you pour that glass of wine or serve that pint of beer to your patrons, take a moment to appreciate your journey to get to this point. The hard work, the research, the patience, and the persistence – it all culminates in that very moment. And trust me, ensuring you have the proper license in place makes those moments even sweeter.

Keep pushing forward, keep aiming high, and remember that in Florida’s restaurant scene, being compliant is being wise. Here’s to every success story yet to be written, every toast to be raised, and every plate to be served.

Raise a glass to your journey ahead, and always remember: the proper license isn’t just a requirement; it’s a badge of honor.

Cheers to your continued success and to the many adventures ahead.

Jeff

Jeff Smith is a Restaurant Consultant with over 20 years of hospitality experience ranging from server to owner and general manager. He focuses on Restaurant POS technology as well as restaurant marketing. Check out our world-famous restaurant resources page for a comprehensive offering of hand-picked resources and tools to help your business. You can also check out some of our other restaurant business articles.